Global Positioning Satellites | Farmer Bob's Parts

Posted by Bobby the Farmhand on Dec 2nd 2020

Global Positioning Satellites guiding Farmers to precise Spraying

The price of GPS (Global Positioning Satellite) guidance system technology continues to decline as its capabilities increase. Many farmers question if or when they should invest in this technology. The major advantage of using GPS is input savings from more precise field application of seed, fertilizers, chemicals, fuel, and labor, as well as increased benefits to the farm production process (extended working time, reduced fatigue, etc.). GPS guidance systems vary in their capability, precision, and costs and, therefore, provide varying levels of input savings. The process of evaluating an investment in any new technology is straightforward and centers on comparing annual costs to annual benefits. If the benefits are greater than the costs, then it’s time to invest in the new technology. Some benefits and costs are easily measured, while others must be evaluated by the business mangers based on their own experiences. The purpose of this publication is to provide an example of the procedures a farmer could use to determine if GPS guidance system technology is a wise investment. It is structured around understanding: 1) how to determine costs, 2) how to measure savings and benefits, 3) how to annualize costs and savings, 4) what the results mean to a farm business, and 5) sensitivity analysis.

GPS Guidance Systems applications provide a means to precisely apply pesticides, lime, fertilizers, and track wide planters and drills. GPS navigation tools can replace foam and planter disk markers for making parallel swaths across a field. Navigation systems help operators reduce skips and overlaps, especially when relying on visual estimation of swath distance and/or counting rows. A GPS system gives the current location of the implement, and past traffic patterns, providing direction to maintain proper swath width to match adjacent traffic paths. So if an operator leaves the field to refill the applicator or is forced out of the field due to weather, the operator can resume and maintain accurate swath widths and eliminate over-spraying on previous areas. For more detail concerning GPS technology, see Precision Farming Tools: GPS Navigation, Virginia Cooperative Extension Publication 442-501 at http://pubs.ext.vt.edu/442-501/.

Investment Costs: A guidance system ranges in price from less than $2,000 for a light bar navigation system with an accuracy of approximately one foot to $40,000 or more for autopilot systems with 1-inch accuracy (Table 1). In between are mechanical steering systems that can be moved between tractors or self-propelled equipment and trucks equipped with the necessary equipment that require investments of approximately $6,500. For purposes of this publication, the $6,500 mechanical steering system will serve as an example to illustrate the basic concepts needed to make an investment decision.

Table 1. A partial listing of GPS guidance systems and prices

Entry-Level Guidance System - 1-foot accuracy Color screen light-bar systems, remote keypad, and WAAS1 corrected yields approximate 1-foot accuracy$1,895

Entry-Level Guidance System - 3-inch accuracy

Color screen light-bar systems, remote keypad, and beacon-correction yields approximate 3-inch accuracy$5,000

Mechanical Steering Systems - 3-inch accuracy

Mechanical steering system, plus 2 brackets, color screen navigation system, and beacon-corrected yields approximate 3-inch accuracy$6,500

Estimating Costs: We will now leave the world of certainty (purchase price), and begin by making three general assumptions to analyze the $6,500 purchase. First, for any asset that has a useful life greater than one year, we need to make an assumption about how long this asset will last before it is obsolete or worn out. This becomes critical with new technology, as was shown with microcomputers and software in the 1990s. During the early years of microcomputer adoption, a new microcomputer with current software was usually obsolete within two years and needed to be replaced, even though the hardware was still functional. Jump ahead to today – microcomputers and their software technology are replaced when they fail or wear out, just like other capital assets. For this example, we will assume a useful life of 5 years, with a cautionary note that less costly and improved newer technology may make our guidance system obsolete in two to three years.

Second, what are the opportunity costs of investing in the guidance system? By definition, opportunity cost is the net income given up by choosing to invest in a guidance system rather than, for example, a brush hog. The main point is that you recognize that investing capital comes with a cost, regardless of the financing source (owned and/or borrowed capital). The opportunity cost of capital is usually expressed as an interest rate and should reflect a similar level of risk, for example, a savings bond may pay a rate of 3 percent versus estimated long-term returns from a stock portfolio of 12 percent. Alternatively, if you know your farm’s return on assets, then this would be a good choice. For this example, we will use 10 percent reflecting higher opportunity costs and uncertain benefits to an individual farm from a GPS system.

Third, what assumptions must be made to estimate repair, maintenance, and software upgrades of the guidance system? Currently there are no industry standards for repair, maintenance, and upgrade costs that individual farm operators can use to estimate annual costs. Furthermore, software and firmware (a device with embedded software) updates depend on a company’s policy, and upgrades may be free or come at a cost. Your current system may become obsolete if the company produces new equipment or software, and repairs to the current system may be unavailable at any cost. Thus, if the equipment fails, the whole system must be replaced. For this example, repair costs are estimated as 10 percent of the original purchase price, and are spread over the life of the asset. An alternative assumption could be to shorten the useful life of the asset to the equipment warranty period, assume no repair costs, and replace the entire system at that time.

Savings and Benefits: Balancing the annualized costs are the input savings (seed, fertilizer, pesticides, herbicides, and machinery fuel and repairs). Studies indicate that input savings range from 2 percent to 7 percent. The savings will also vary within a farm, depending on field and equipment size and the level of inputs used. For example, no-till corn requires only two passes, one for burn-down herbicides and the second to plant and apply fertilizer, while a conventionally tilled vegetable crop requires multiple passes for spraying and cultivating. The higher the costs of inputs (such as petrochemicals and fuel), the faster savings will accrue to the guidance system. For this example, savings of out-of-pocket expenses will be estimated over a range from 2 percent to 7 percent.

Field size and shape need to be considered for this investment. Common sense tells us that large fields provide for more efficient machinery operations, while small or oddly shaped fields increase machinery time. Even the simplest guidance systems can increase efficiency by recording each pass and guiding the driver to minimize overlaps and skips. Incorporating guidance systems and application controls on planters and sprayers (individual controls of nozzles and planters) can further reduce costs and improve efficiency on oddly shaped fields by sequentially turning off and on an individual nozzle or planter. Farmers that recognize that they have problems making the trade-offs between skips and overlaps with their current equipment and field shape/size should see more than an average saving on out-of-pocket expenses. Thus, instead of using an average savings of 4 percent consider 5 percent to 6 percent in your analysis.

Annualized Costs: Annualizing all costs is the next step in determining if investing in a guidance system will improve the bottom line. Table 2 summarizes in numbers the verbal discussion from the sections above. Line 1 is the total investment being considered in our example – the $6,500 for mechanical steering and guidance systems. We next enter a salvage value in Line 2. Estimating a salvage value for an asset is difficult (as discussed above). For this example, we will assume that the guidance system will become obsolete at the end of its useful life and have no salvage value.

Table 2. Total annual costs - GPS mechanical steering system

1. Initial investment $$6,500

2. Salvage value $$0

3. Amount to be recovered (Line 1 – Line 2) $$6,500

4. Interest rate (i) 0.1

5. Estimated life of the asset in years (n)5

6. Capital recovery factor10.26380

7. Annual recovery amount (Line 6 x Line 3) =$1,715

8. Annual repair costs - 10% of new over life of the asset$130

9. Annual subscription fee$0

10. Total annual costs (Lines 7 + 8 + 9)$1,845

Capital Recover = i/1-(1+ i)-n

Where: i = annual interest rate and n = life of the asset in years.

If you choose to enter a salvage value, then line 1 less line 2 yields the value to be recovered over the life of the asset, which is entered on Line 3. On Line 4, we enter the interest rate or opportunity costs for capital invested in the farm business, for this example it is 10 percent. On Line 5, we enter the useful life of the asset being evaluated, for this example, five years. On Line 6, we enter the capital recovery factor based on the estimated life of the asset in years (n) and interest rate (i) by looking up the value in the Appendix or by calculating the value using the equation at the bottom of Table 2. On Line 7, we enter the product of Line 6 times Line 3, the annual charge for the guidance system, in this example, $1,715.

The capital recovery method assumes that at the end of five years, the five annual payments of $1,715 will provide sufficient capital to replace the guidance system with comparable/updated technology (equivalent technology at the time of replacement). On Line 8, we record the estimated annual repair costs. For this example, we based the estimates on 10 percent of the purchase price over the life of the asset or $130 per year. On line 9, we enter any subscription fees (for our example, with the use of beacon-corrected accuracy, there are no additional fees). However, if considering higher accuracy systems, such as a real-time kinematic (RTK) farm station, enter all annual fees and the cost of service calls. Sum up Lines 7, 8, and 9 and enter the total on Line 10 (in this example, $1,845). This is the annualized cost of owning and operating a color screen navigation system with beacon-corrected mechanical steering systems with estimated 3-inch accuracy.

Estimating the Benefits: There are two major ways to estimate benefits or savings from more accurate field operations: 1) case studies comparing costs and benefits of a specific farm, detailing the cropping system, machinery size, and number of passes and all applied benefits, and 2) partial budgeting to analyze replacement of an existing technology (foam markers).ystems and rotations, and that input costs vary greatly between and within farms based on the cropping system.

The final decision to invest in the $6,500 GPS navigation system is a balance between the costs as detailed above and the estimated benefits from input savings and improvement in labor efficiencies. Thus, another farmer with similar cropping practices and costs and farming, say 800 acres, would benefit from this investment. A farmer with fewer than 200 acres would not benefit. Between these two points, there is a judgment call based on personal knowledge of the farm and management system in place.

Summary: Investments in technology must generate direct cost savings, provide additional revenues, and/or increase benefits to the farm production process to be a sound investment. The above examples illustrate how you can, based on your own records, determine if a guidance system can save enough to justify the investment. The additional information listed below is for use with the form in the Appendix.

A cautionary point – If your farm is less cost efficient, i.e., excessive inputs of fertilizers and pesticides, the greater the benefit from a guidance system. Therefore, make sure all inputs are efficiently used before using your historical data to make this new investment!

Custom operators – if you hire a custom operator who uses a guidance system, then there may be limited efficiency savings from purchasing a GPS system for your farm. Reduced inputs are the major advantage of the technology and are already captured by the custom operator, and some of that savings may be passed on to you. The question still remains about how much time can be saved from reduced scheduling conflicts and timelier applications. Farmers who own their own equipment have the freedom to move the guidance system among such equipment as planters, sprayers, and fertilizer and manure spreaders.

Farms with high-value crops requiring multiple trips, applications, bedding, and/or installation of plastic mulch and drip irrigation (e.g., peanuts, vegetables, cotton, and/or organic crops) will have lower breakeven acreage based on direct input savings.

The key to making this decision is to accurately estimate the level of saving on inputs needed to pay for the guidance system!

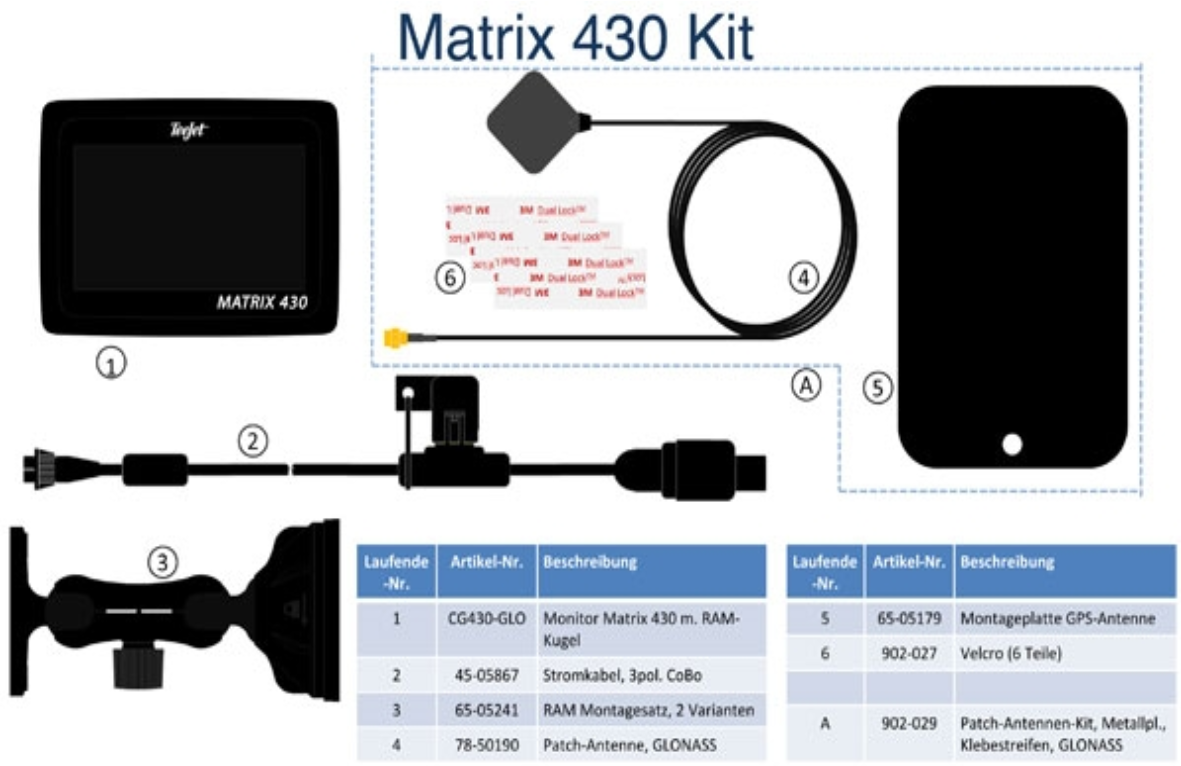

P.S We carry the Centerline 220 & the Matrix 430 by TeeJet at the best price on the internet. https://farmerbobsparts.com/teejet-technologies-c...